Wyoming offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Energy Generation & Extraction

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Wyoming State Capitol

200 W 24th St, Cheyenne, WY 82001

(307) 777-7881

[email protected]

Monday-Friday, 8:00 a.m. – 5:30 p.m.

Rocky Mountain Power

2901 Yellowstone Rd

Rock Springs, WY 82901

(888) 221 7070

(877) 508-5088

Wyoming Energy Authority

1912 Capitol Ave Ste 305

Cheyenne, WY 82001

(307) 635-3573

[email protected]

Monday-Friday, 8:00 a.m. – 5:00 p.m.

Cheyenne Weather Bureau

1301 Airport Parkway

Cheyenne, WY 82001-1549

(307) 772-2468

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Wyoming Clean Energy Power

Zero Emission Vehicles

Energy Generation & Extraction

Energy Distribution

Contact

Solar for All

CarbonSafe Initiative

Incentive Lists

Power Outage Map

Wyoming Public Service Commission

2515 Warren Avenue, Suite 300

Cheyenne WY 82002

(307) 777-7427

[email protected]

Wyoming Solar Evergy Overview

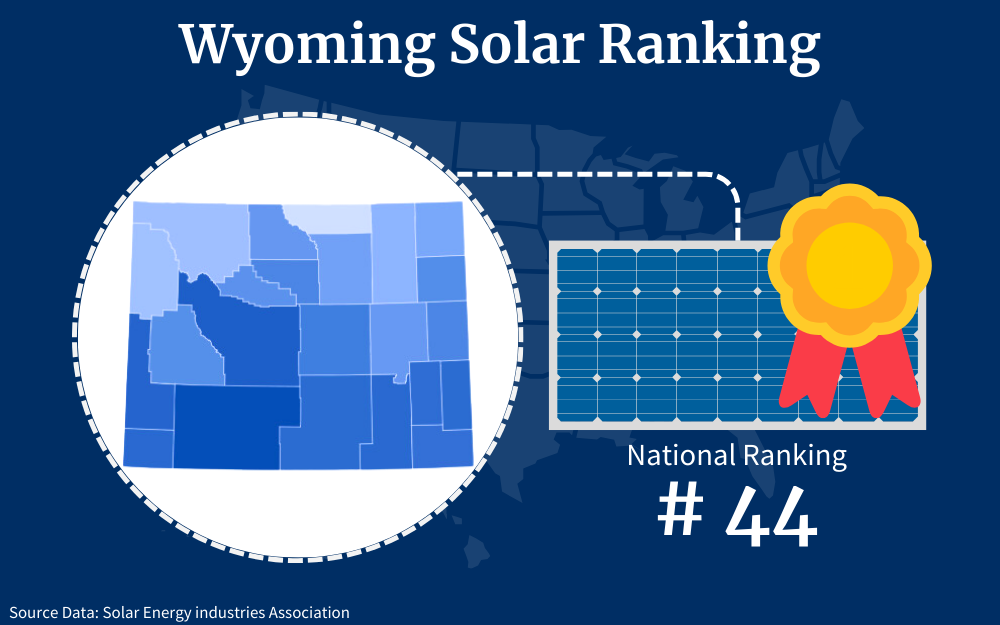

Wyoming solar incentives are helping to change the perception that the state isn’t suitable for solar energy. Wyoming has been increasingly adopting solar power over the past decade, although the state currently ranks 44th in the nation for solar adoption.

This is why incentives can help increase the number of residents who install home solar energy systems. The costs savings can be significant.

There are several federal and Wyoming solar incentives in place to make solar energy more enticing to home and business owners. Despite having 2.5% of the United State’s dry natural gas reserves,1 Wyoming has a high solar potential.

If you’re thinking about solar, you’ll be happy to know that the federal government has a few solar programs in place to cut costs.

By taking advantage of these incentives, you can offset the cost of your home’s new solar energy panels and significantly lower your energy bills (and your footprint).

Solar Credits That Apply in Wyoming

One of the best ways to save on your solar panels is to take advantage of the federal program known as the Federal Solar Tax Credit.2

Sometimes, people refer to this national solar energy program as the Investment Tax Credit or ITC.

As long as you buy (whether you own or finance) a new photovoltaic (PV) system in Wyoming for a home you live in, you could qualify for ITC tax credits. All Wyoming residents could be eligible if they meet a few basic requirements, such as owning the system and residing in the home.

With this program, you can get a tax write-off of as much as 30% of your total solar panel system cost when you file your federal taxes. The average system costs about $23,130, and the tax credit brings that number down to just over $16,000.

How the Credits Work?

Redeeming your tax credits is a relatively simple process. When you file your income taxes for the year your system was installed, you can receive your credit.

But you can only receive the money as a credit towards the income taxes you owe.

For instance, you might have a tax liability of $5000. If your tax credit is $7,000, you can only use $5,000 of the credit.

The following year, you could redeem the remaining credit for your tax liability. You have up to five years to redeem all of your credits.

If you’re renting out a home you own with solar, you cannot claim the full tax credit. You need to determine the percentage of time you live in that home, and that is the percentage of tax credit you receive.

If you don’t live in the rental property at all, you can’t claim the tax credit.

How To Claim Wyoming Solar Credits

To claim Wyoming solar credits, you’ll need to download the relevant form from the IRS website. Known as Form 5695,3 the document asks for details about your solar panel system as well as your property.

To fill out the form correctly, you may need to reach out to your solar panel installation company. They’ll have all the specifics the form requests.

Step 1: Obtain the form

Step 2: Fill out the needed information as asked by the form

Step 3: Transfer the Credit to your Tax Return

Step 4: File your Tax Return

After you fill out the form, you need to file your taxes. If an accountant does your taxes, give them the form.

If you do your taxes yourself, you should be sure to attach the form with your documents. Certain tax software, like TurboTax,13 prompt you to answer questions for the tax credit.

With these programs, there’s no need to fill out Form 5695.

EERE Programs Explained: Residential Solar Tax Credits

In 2021, there were 6,500 people employed in Wyoming employed in the energy efficiency sector.4 The state has seen many residents take advantage of the Efficiency and Renewable Energy (EERE) initiatives.

Here’s a look at some of the solar tax credits you may be eligible for.

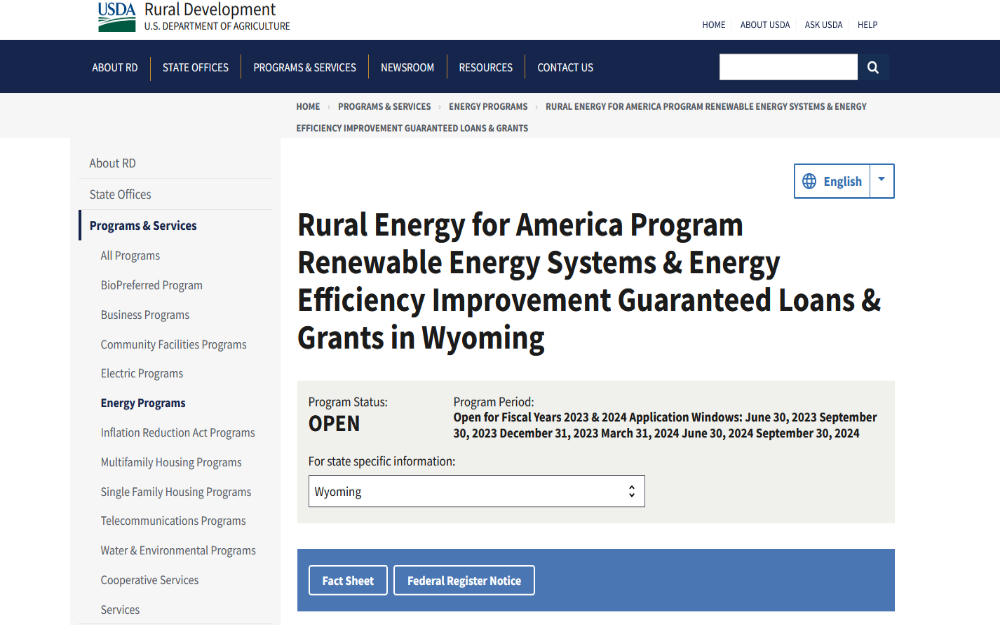

Rural Energy for America Program (REAP)

This federal program gives loans and grants to small business owners and farmers who install solar panels or other forms of clean energy. To qualify for REAP,5 a farmer needs to make at least 50% of their income from agricultural means.

A small business only qualifies if they’re located in an eligible rural area.

Although the majority of homeowners won’t qualify for this incentive, some homesteaders may qualify. Eligible participants can save up to 80% of the project in loans or 40% of the installation via grants.

Net Metering

Another option for Wyoming residents to save money is through net metering. With net metering, you earn credits when your solar panels produce excess electricity.

You send the extra power to your closest electricity grid, and then you receive credits towards your electricity bill.

If you don’t use the credits for tapping into the grid, they roll over to the end of the year. At that point, your utility company needs to buy back the credits at a certain rate.

It’s worth noting that some providers offer the full rate for credits while others pay a lower rate. Because the Wyoming Public Services Commission mandates net metering in all of Wyoming,6 every area in the state has the program.

To enroll in this program, you simply have your solar installer apply for a connection with your utility company’s grid. It requires an inspection, but there’s not much you have to do to get set up.

Local Solar Incentives

It’s not unusual for local cities or solar companies to offer loans and rebates to homeowners who go solar.

Before you install your system, contact your local government and solar company. Ask them if they have any rebate or loan programs for solar customers.

Federal Solar Tax Credit

As previously mentioned, the Federal Solar Tax Credit is a great way to get money back after you install your solar panel system.

You can receive a large credit on your federal income tax if you install a system on your home.

Dominion Energy Wyoming Solar Assisted Water Heating

For customers of Dominion Energy, certain water heating equipment and upgrades can qualify for $750 rebates.

The solar assisted gas water heating rebate for both homes and pools can be obtained by submitting your application with the serial number of the appliance to the provider, within six months of the purchase.

To learn more or enroll for this renewable energy solar rebate, visit the provider’s website.

What Materials and Parts Do You Need for Solar Panel Systems?

Although solar panel systems are challenging to install, they’re relatively simple in design.

To get started, you’ll need to know how to make solar panels and gather the following items:

Solar Panels

These panels collect energy from the sun and then convert the energy to electricity. All of this is possible because of the photovoltaic nature of the solar panel.

Batteries

If you have a system without batteries, the system will only provide power when the sun is shining on the panels. When a system has a battery, it’s able to store electricity and discharge it whenever you need it.

You can have a system with no battery, but you would still need to tap into your local electric grid for power when the sun isn’t out.

Charge Controller

This part is responsible for preventing damage to the batteries. Essentially, the charge controller keeps the batteries from being overcharged.7

Without a charge controller, a battery would have a short life span.

Power Inverter

Once again, this is a part that is necessary for systems with batteries. The power converter converts a low-voltage DC to the appropriate voltage for your appliances.

However, the converter serves another purpose. It charges the batteries if they’re connected to a utility grid or AC generator.

What Do the Materials Cost?

The average price for solar panels in Wyoming is $2.57 per watt, making it more affordable than the national average of $3 per watt for low cost solar panels.

Although the size of your system will depend on a variety of factors, the average homeowner needs a 9kw system to eliminate the need for using electricity from the grid.

Therefore, the average solar panel system in Wyoming costs $23,130. After the rebate, the total cost is $16,191.

The equipment itself is expensive, with a polycrystalline solar panel costing between $.90 and $1.50 per watt.

Other types of panels, such as monocrystalline panels, cost between $1 and $1.50 per watt.

If you want a system with a battery, you should expect to pay between $200 and $14,000. Just as there are different types of panels, there are different types of batteries.

The cheapest battery type is the lead-acid battery, but it won’t power your appliances.

Other costs to consider include:

Permits

Your solar company should handle the permitting as well as the permit costs. Because the costs vary by county, you should reach out to your local government for information.

Warranties

Generally speaking, solar companies have a 25-year warranty. Before you agree to any terms, read the fine print and find out about the warranty, as this could help you navigate potential solar energy problems down the line.

Labor

Installing a solar panel system is no easy task. When you receive a quote for your system, it includes labor.

How To Use a Residential Solar Panel Calculator

You need the right amount of solar panels to power your home. Fortunately, there’s an easy way to determine how many panels you need in your system.

By using a residential solar panel calculator,8 you can determine exactly how many panels you need to have a successful system.

First, you need to calculate your solar panel needs, also known as the solar array output. If you don’t have access to a solar calculator, you can determine it by using this formula:

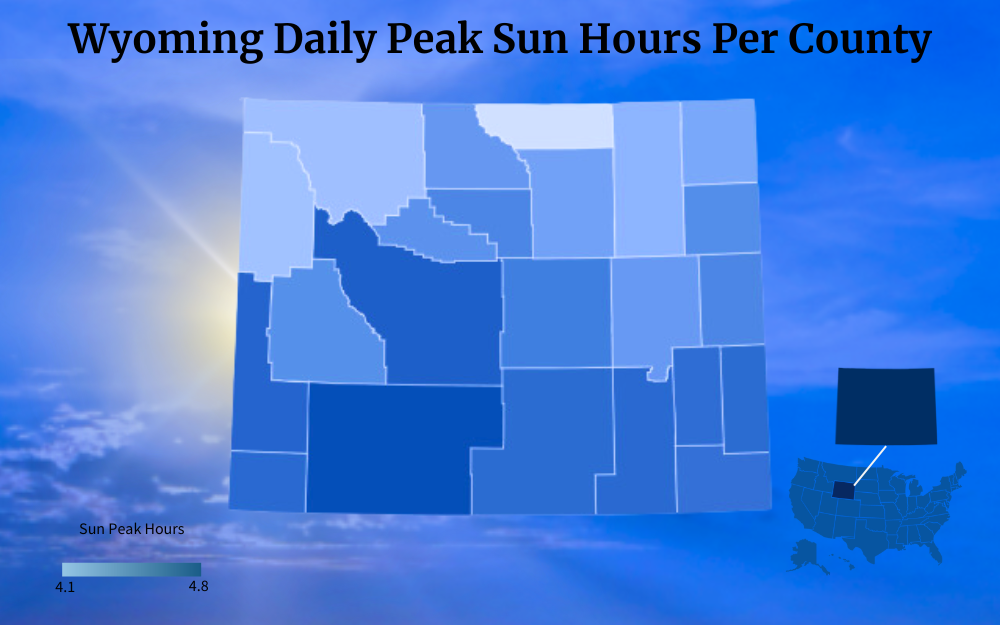

- Yearly electricity consumption / (365 *solar hours per day)

The solar hours per day vary because some areas receive more sun than others. Keep in mind that the yearly consumption should be in kWh.

If your meter uses other units of measurement, convert the number to kWh.

As you do the math, you need to think about how much you want to depend on solar. If you want to rely on solar 50% of the time, use that in the next equation.

The solar cost calculator will use this formula:

- Solar array output*(bill offset/environmental factor) = solar array size.

Similar to the bill offset, the environmental factor is a percentage. It takes into account the percentage of energy produced by the array and stored without loss.

Oftentimes, humidity, pollution, and similar conditions affect this number.

Determining Your Roof Area

One of the hardest parts of the calculations is estimating your roof area. If you have an oddly shaped roof, this could be difficult.

You can use an online roofing calculator or estimate it yourself. Ignore any areas of the roof that are always in the shade, or that wouldn’t be able to hold solar panels.

How Many Panels Do You Need?

Next, the calculator determines how many solar panels you need for your ideal output. This formula is :

- The solar array size in kW8*1000/panel output in watts = required panels

The output is usually 300 watts, but that can vary.

Finally, the calculator uses this formula:

- Panel length*panel width*required panels = area occupied.

The width and length should be in meters. As long as the occupied area is less than your total roof area,9 you can install the system.

Take the system size divided by the single panel size, and you have your total number of panels.

Understanding the Solar Panel Calculator

Although the calculations above explain how to determine the amount of panels you need, you don’t need to rely on them. Instead, you can just input the right numbers in the calculator.

You’ll need all of the following:

- Usable roof area

- Solar panel dimensions

- Yearly energy use

- Bill offset

- Environmental offset (the calculator should tell you this)

- Photovoltaic cell efficiency

If you have a small roof, you may want to consider using highly efficient panels. You would need fewer panels to provide the desired output and this choice can significantly impact solar energy production for your home.

As long as the total system output meets your needs, the amount of panels isn’t important.

Does Wyoming Offer Net Metering and Power Purchasing Agreements (PPA)?

Throughout the state of Wyoming, all electric companies offer net metering. Net metering is what happens when you sell the extra electricity produced by your solar panels.10

If you’re signed up for the program, your electric company takes the excess energy from your panels. The credits go towards your electric bill, if you have one.

In the event that you don’t use the credits, they roll over every month until the year is over. At the end of the year, the electric company pays you for the excess credits.

The amount of your payout depends on how many credits you have and what the electric company is willing to pay for them.

Ultimately, net metering helps your solar system pay for itself. It’s similar to the tax credit in that you can recoup some of your money.

As long as you’re producing more energy than you’re using, there’s an opportunity for you to earn.

What About PPA?

How to get solar panels from government free? Unfortunately, there are no free solar panels.

However, a Power Purchasing Agreement is an alternative to ownership. The installer maintains ownership of the system and charges you a fixed rate for using it every month.

Another opportunity for earning money is through a PPA. Typically, people buy a solar system and then own the whole system.

During some months of high energy use or low energy production, you may need to pay the leasing company as well as your utility provider. However, a PPA can still save you money on electricity.

There are no upfront costs of installation, and you have less responsibility for maintaining the system. Even though you won’t qualify for the tax credit, you can still decrease your energy bills with a PPA.

What Forms Do I Need To Fill Out To Get the Credit?

There’s only one form you need to receive the tax credit.11 To qualify for the credit, fill out the IRS Form 5695.

The form requests details like the size of the system, as well as contact information.

Due to the absence of state rebates beyond net metering, there are no additional forms to submit for Wyoming solar incentives. Net metering is a transaction that takes place between you and the utility company.

Where To Buy Solar Panels in Wyoming?

Once you make the decision to go solar, you have an even bigger choice. You need to decide where to purchase your solar panels.

Before you settle on a particular provider, it’s important to research local solar companies and know how to test solar panels for quality and efficiency.

The following tips can help you make the best decision for your home:

Ask Neighbors for Recommendations

Before you start looking online for solar companies, talk to your neighbors. Find out who they used for their solar panels.

Then, ask about their experience. Was the company thorough?

How do they solve issues with solar panels? Were they easy to work with?

If not, look for a different company.

When you receive genuine testimonials, you’re getting all the details you need to make an informed decision.

If your neighbors don’t have direct experience with a solar company, ask around on social media. Post in local Facebook groups for recommendations.

As you read responses, remember that some people may only recommend a company because a family member owns it. You should make a list of all the recommended companies and research them.

Check for an Online Presence

After you have a list of companies, check out their websites and social media accounts. The company should have a professional online presence and some information about its services.

There are good companies that don’t have a strong online presence. However, you should at least be able to find a website or some basic information about the company.

Read Reviews

You should always read a solar company’s reviews before you hire them.12 If the company is on Google, read those reviews first.

A good company can have a few bad reviews, but those reviews shouldn’t echo the same issue. When multiple reviews complain about the same thing, you’re looking at a red flag.

As you read reviews, pay attention to the following details:

- Communication with customers

- Speed of the process

- How they handled problems

- Overall customer satisfaction

Verify Licenses and Certifications

Not all solar companies are reputable. To protect yourself from shoddy work or other issues, check into the company’s licensing and insurance.

Only work with companies that have active licenses and insurance policies.

If you choose to work with an unlicensed or uninsured solar company, you could face consequences. You might end up unable to permit your system or be on the receiving end of a personal injury lawsuit.

Ask your prospective company for their information and make sure everything is active.

Get Multiple Quotes

When you’re looking for a solar company, you should get at least three quotes. You shouldn’t choose the cheapest company but should instead pick the company that has the best value.

For instance, one company might have a longer warranty and better service than another company. Even if the company is $1,000 more expensive, it could be worth working with them.

Compare prices and services. At this point in time, you should call up each company and ask them questions.

Find out about the warranty, timeline, and any other details that could help you make a decision.

If you live in Wyoming, you can benefit from lower energy bills by installing solar panels. But there’s more to going solar than cutting ties with the electric company.

You can also receive a credit on your taxes and participate in a buyback program when you overproduce energy.

Depending on your area, you may be eligible for local rebates as well.

With all the advantages of going solar and the environmental impacts of solar energy, you have a lot to gain by installing a new system and taking advantage of the benefits provided by Wyoming solar incentives.

Frequently Asked Questions About Wyoming Solar Incentives

Are Solar Panels in Wyoming Cheaper Than in Other States?

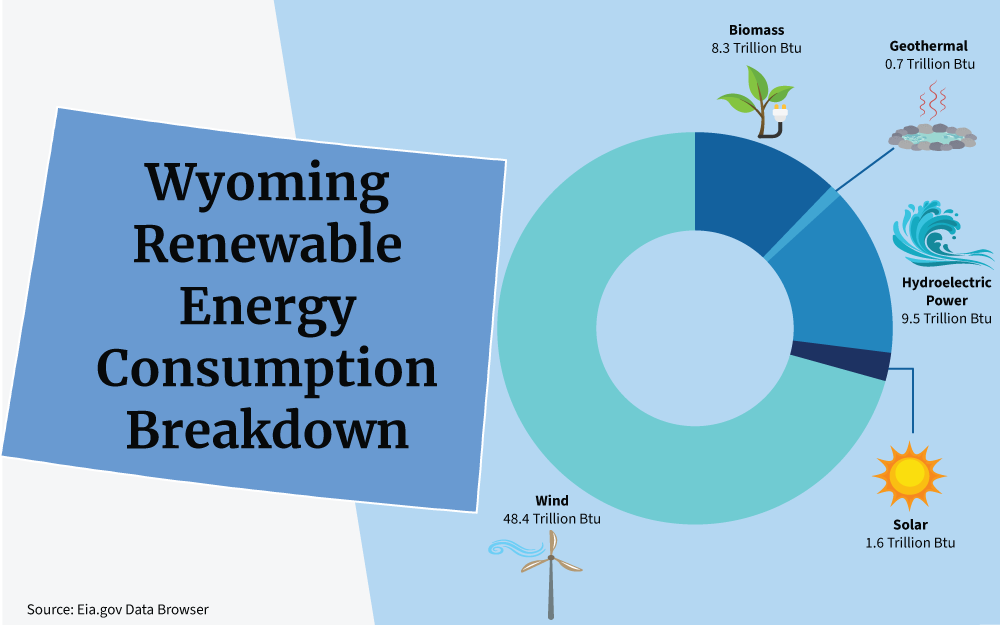

In Wyoming, solar panels are more affordable than the national average, costing about $2.57 per watt compared to the national $3 per watt. Despite the lack of state-specific incentives, Wyoming remains a cost-effective location for solar panel installation and already generates 24% of its electricity from renewable sources.13

What Solar Incentives Are Available in Wyoming?

Wyoming residents can use the federal solar tax credit to receive credits when they file their taxes. Additionally, residents can take advantage of net metering to offset their dependence on the power grid or to receive a payout at the end of the year.

How Do I Determine How Many Solar Panels I Need?

By utilizing an online solar calculator, you can estimate the number of solar panels needed for your desired energy output by inputting basic information like roof size and annual electricity usage. Remember, the total number of panels you’ll require can vary depending on their efficiency.

References

1Wyoming State Geological Survey. (2023). Wyoming State Geological Survey. Wyoming State Geological Survey. Retrieved September 15, 2023, from <https://www.wsgs.wyo.gov/energy/oil-gas-facts.aspx>

2US Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

3IRS. (2022). Residential Energy Credits. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

4US Department of Energy. (2023, June 20). Energy Facts: Impact of the Investing in America Agenda on Wyoming. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/articles/energy-facts-impact-investing-america-agenda-wyoming>

5USDA Rural Development. (2023). Rural Energy for America Program Renewable Energy Systems & Energy Efficiency Improvement Guaranteed Loans & Grants in Wyoming. USDA Rural Development. Retrieved September 15, 2023, from <https://www.rd.usda.gov/programs-services/energy-programs/rural-energy-america-program-renewable-energy-systems-energy-efficiency-improvement-guaranteed-loans/wy>

6WY Public Service Commission. (2023). WY Public Service Commission – Certificated Utility Maps. WY Public Service Commission. Retrieved September 15, 2023, from <https://psc.wyo.gov/home/certificated-utility-maps>

7Khamisani, A. A. (2018). Design Methodology of Off-Grid PV Solar Powered System (A Case Study of Solar Powered Bus Shelter) Author: Ayaz A. Khamisani Adv. Eastern Illinois University. Retrieved September 15, 2023, from <https://www.eiu.edu/energy/Design%20Methodology%20of%20Off-Grid%20PV%20Solar%20Powered%20System_5_1_2018.pdf>

8NREL. (2023). PVWatts® Calculator. PVWatts Calculator. Retrieved September 15, 2023, from <https://pvwatts.nrel.gov/>

9U.S. DEPARTMENT OF LABOR. (2023). 1926 Subpart M App A – Determining Roof Widths – Non-mandatory Guidelines for Complying with 1926.501(b)(10). Occupational Safety and Health Administration. Retrieved September 15, 2023, from <https://www.osha.gov/laws-regs/regulations/standardnumber/1926/1926SubpartMAppA>

10Boudewyns, A. (2019, April 25). Research Memorandum Net Metering. Wyoming Legislative Service Office. Retrieved September 15, 2023, from <https://wyoleg.gov/LSOResearch/2019/19RM024.pdf>

11IRS. (2023, August 28). Residential Clean Energy Credit | Internal Revenue Service. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

12US Department of Energy. (2021, August 31). Decisions, Decisions: Choosing the Right Solar Installer. Department of Energy. Retrieved September 15, 2023, from <https://www.energy.gov/eere/solar/articles/decisions-decisions-choosing-right-solar-installer>

13Intuit, Inc. (2023). TurboTax Official Site. TurboTax. Retrieved September 16, 2023, from <https://turbotax.intuit.com/>